TAX BROKE

A TRNN Investigative Series

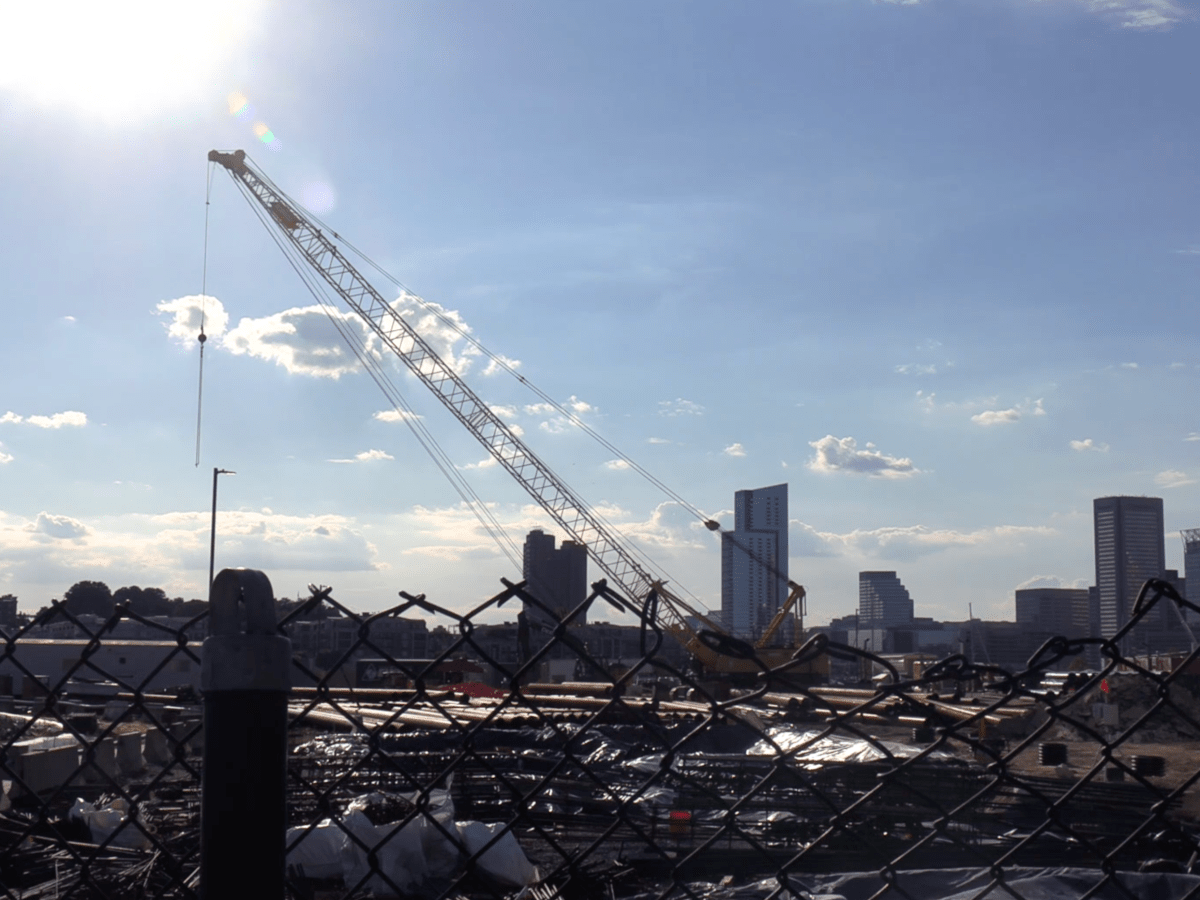

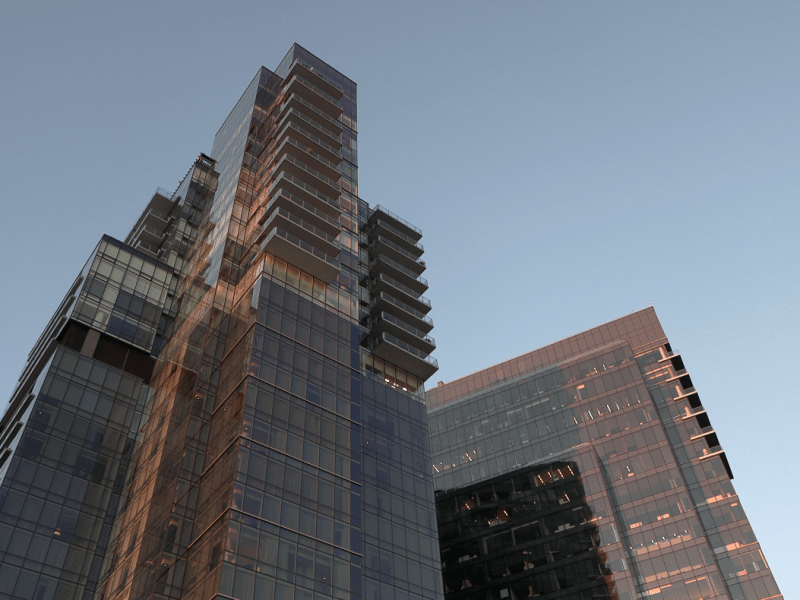

For decades, Baltimore has struggled to grow, hamstrung by a property tax rate twice that of the surrounding counties, a lack of affordable housing strategy, and underinvestment in education. The unequal burden has prompted the city to pursue a risky strategy of effectively paying developers to build.

Using incentives with innocuous sounding acronyms like TIF and PILOT, new construction in the city has occurred largely at the expense of the city’s working class. Meanwhile, despite the promises that these incentives would reverse the city’s decline, Baltimore continues to lose population.

How did we get here? Why is Baltimore the only jurisdiction in the state that must pay for development? And is there a better way to grow a city?

Watch the full documentary

Tax Broke: How opaque tax breaks for developers fuel inequality in Baltimore

These are just a few of the questions that our ongoing investigation, Tax Broke, will try to answer. The centerpiece of the project is an investigative documentary of the same name. The film—five years in the making—explores the history of the city’s fraught relationship with artificially imposed boundaries, codified segregation, and, finally, a political economy fueled by hundreds of millions of dollars in tax incentives doled out behind closed doors.

But the documentary is just a starting point.

Through podcasts, print articles, and video discussions, we will continue to report on and break down the hidden costs, lack of transparency, and practical realities of Baltimore’s struggle to grow. We will update this page with context and data, legislative solutions, and alternative perspectives on how to make Baltimore a viable, healthy, and more equitable community.

Past and upcoming screenings of “Tax Broke”:

- 11-17-2022 Premiere – The Real News Network

- 12-06-2022 Screening for Inclusionary Housing Coalition – The Real News Network

- 1-26-2023 The Charles Theater

- 2-07-2023 Sharp Leadenhall Community Screening

- 2-08-2023 University of Maryland School of Social Work

- 04-06-2023 Heritage Crossing Community Screening

- 04-11-2023 University of Maryland Screening – The Real News Network

Ongoing Tax Broke Coverage

An ethics expert says Sinclair Broadcasting should disclose its business conflicts with Baltimore. I was part of the problem.

Property developers are exacerbating the housing crisis

Union support grows for task force to scrutinize developer tax breaks

Baltimore touts equality, so why did it lavish tens of millions in tax breaks on a single development: Harbor East?

Maryland unions push to expand proposed state probe of business tax breaks

State senator seeks to unearth hidden costs of Baltimore’s developer tax breaks

How ‘urban renewal’ went from a vision for public good to a private enrichment scheme

Baltimore comptroller sidesteps City Council to scrutinize controversial tax break for developers

Maryland state says it doesn’t have to account for spending on tax break costing Baltimore $20 million annually

Past Coverage

The Real News Network has been covering Baltimore’s penchant for awarding tax breaks to developers and lack of affordable housing since 2015. Here is some of our past coverage of these issues as we spoke with activists, residents, and politicians about the city’s uneven and opaque strategy for growth:

Additional Resources and Information

For additional information about the use of tax incentives in communities across the country, here are links to organizations and their data regarding the both the costs and purported benefits of these policies:

CivicLab Chicago

The TIF Illumination Project of the CivicLab in Chicago has been investigating and exposing the hyper-local impacts of TIFs since 2013. They’ve done 187 public meetings and are working with neighbors in 17 cities.

Good Jobs First

Good Jobs First is a national resource center on Tax Increment Financing (TIF) and other economic development issues. In 2003, it published “Subsidizing the Low Road,” a study documenting the failures of Baltimore’s costly “downtown first” spending bias.